pa tax payment forgiveness

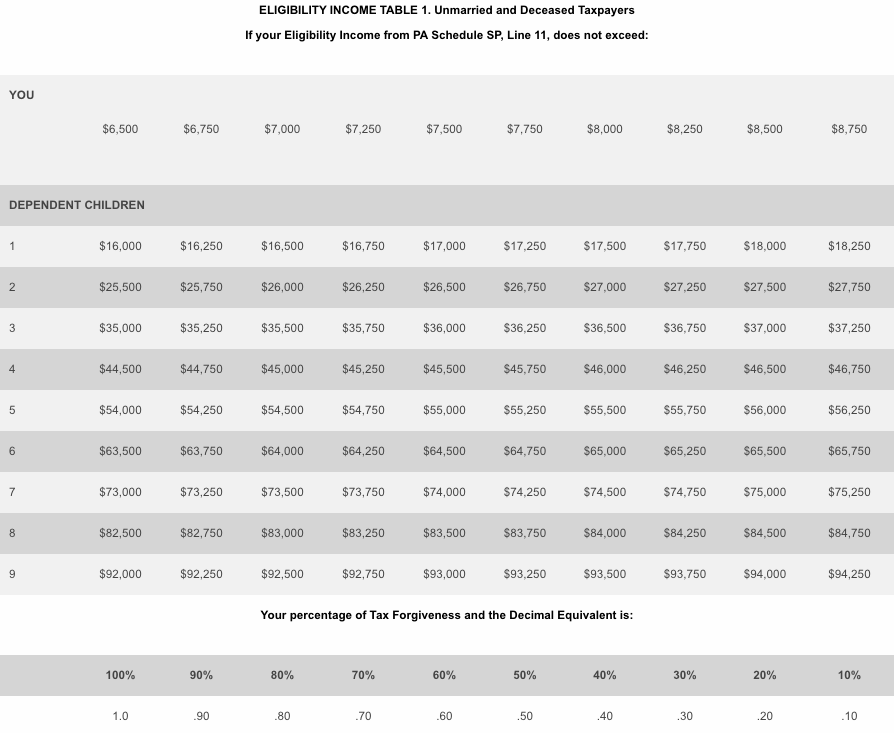

Tax forgiveness gives a state tax refund to some taxpayers and forgives some taxpayers of their liabilities even if they havent paid their Pennsylvania income tax. ELIGIBILITY INCOME TABLE 1.

How To Start Paying Back Your Student Loans Http Back Ly 5afi6 Loans Pay Federal Student Loans Student Loans Student Loan Debt Forgiveness

Generally such loan payments or forgiveness are not subject to Pennsylvania personal income tax unless the student provides services directly to the payor or lender in.

. In Part D calculate the amount of your Tax Forgiveness. Then move across the row to find your eligibility income. The Tax Forgiveness program allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability.

Retired persons and individuals that have low income and did not have PA tax withheld may have their PA tax liabilities forgiven. Ad No Money To Pay IRS Back Tax. Provides a reduction in tax liability and.

Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. Alimony- Alimony payments that you received are not taxable in the state of Pennsylvania. Record the your PA tax liability from Line 12 of your PA-40.

For example a family of. That same family of four with eligibility income more than 34000 but no greater. Tax forgiveness is a credit against pa tax that allows eligible taxpayers to reduce all or part of their pa tax liability.

The Pennsylvania Tax Forgiveness Credit helps eligible PA taxpayers reduce their tax liability. For taxpayers who earn a wage the employee can. Retired persons and individuals that have low income and did not have PA tax withheld may have their PA tax liabilities forgiven.

Tax Forgiveness is a credit against PA tax that allows eligible taxpayers to reduce all or part of their PA tax liability. Ad No Money To Pay IRS Back Tax. What is Pennsylvania special tax forgiveness credit.

Who can claim pa tax forgiveness. Retired persons and individuals that have low income and did not have PA tax withheld may have their PA tax liabilities forgiven. For example a family of four couple with two dependent.

To claim this credit it is necessary that a taxpayer file a PA-40. Record tax paid to other states or countries. Eligibility income for Tax Forgiveness is different from taxable income.

At the bottom of that column is the percentage of Tax Forgiveness for which you qualify. Personal Income Tax Payment. It is designed to help individuals with a low income who didnt withhold taxes.

Tax forgiveness gives a state tax refund to some taxpayers and forgives some taxpayers of their liabilities even if they. Tom Wolf Governor C. Eligibility income is greater because it includes many nontaxable forms of income such as interest on savings.

However any alimony received will be used to calculate your PA Tax Forgiveness credit. Realty Transfer Tax Payment. Eligibility income for Tax Forgiveness is different from taxable.

Wolf notes that for a public service worker with 50000 in forgiven student loans in Pennsylvania will now be able to avoid a 1535 state income tax bill. For example a family of four couple with two dependent. 90 percent tax forgiveness if their eligibility income is more than 32000 but no greater than 32250.

Pennsylvania Special Tax Forgiveness Credit Do You Qualify Supermoney

New Rules For Student Loan Forgiveness Program Might Help You Student Loan Repayment Student Loan Payment Student Loan Forgiveness

Student Loan Forgiveness Is Taxed In These 13 States Bloomberg

Good News Pennsylvania Won T Tax Your Student Loan Forgiveness After All Pennlive Com

There S A New Tax Refund Available In Philadelphia This Year Philadelphia Legal Assistance

Ivca Ispirt Demand Better Tax Regime Nasscom Supports Govts 2030 Vision Here S Everything Indian Private Student Loan Payment Tax Refund Student Loan Repayment

Chapter 13 Bankruptcy Vs Chapter 7 Bankruptcy Visual Ly Chapter 13 Bankruptcy Bankruptcy Quotes

10 Quirky Social Security Facts You Need To Know The Motley Fool Retirement Age Student Loan Forgiveness

Extend Mortgage Cancellation Tax Relief Real Estate Agent And Sales In Pa Mortgage Debt Mortgage Loan Originator Debt Relief

Pa Property Tax Rent Rebate Apply By 12 31 2022 New 1 Time Bonus Rebate Announced 8 2 2022 Legal Aid Of Southeastern Pennsylvania

U S Student Debt May Be A Crisis Now Soon It Will Be A Catastrophe Student Loans Student Loan Forgiveness Federal Student Loans

Pin On Freedom Insurance Group Inc

Pin By Andrea Bradley Golombeck On Dental Insurance Plans Dental Insurance Plans Dental Insurance Dental

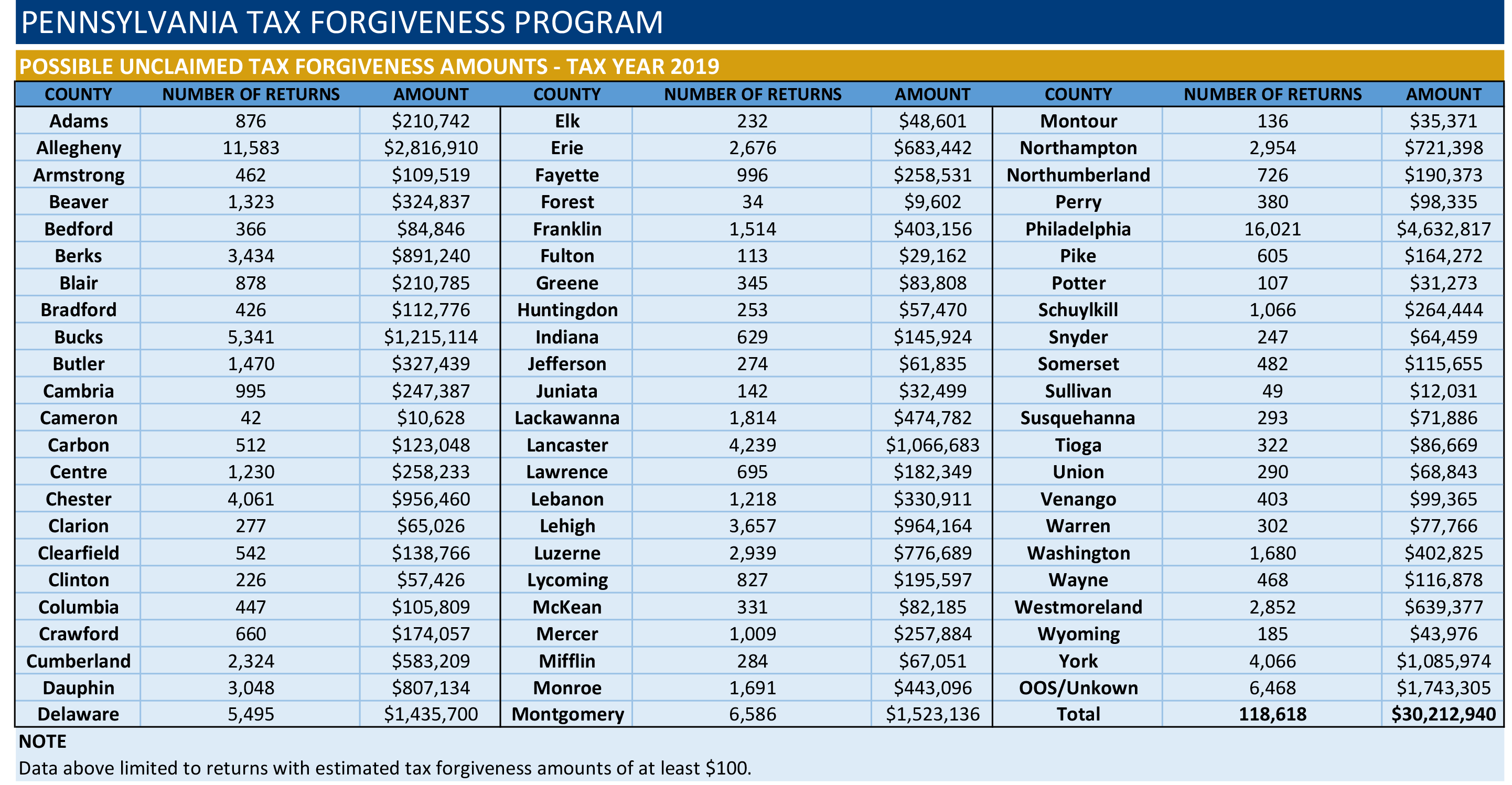

Low Income Pennsylvanians May Be Missing Out On Pa Tax Refunds Of 100 Or More

Barton Associates Pa Scope Of Practice Laws

What Does The Cares Act Mean For Pslf Borrowers Future Proof M D The Borrowers Public Service Loan Forgiveness Federal Student Loans

Picpa Committee To Vote On Pass Through Entity Tax House Bill 1709 Wilke Associates Cpas

2400 Update Two Major Raises For Social Security Ssi Ssdi Stimulus Pa In 2022 Stock Market Tax Refund Daily News